Kelly Criterion Betting Strategy

Named after its developer, the Kelly Criterion is a mathematical formula that helps individuals determine the optimal amount of capital to allocate to a particular investment to maximize long-term growth.

The concept behind the Kelly criterion betting strategy is simple. It is good for betting on the newest betting sites. For every investment, there is a probability of making a profit or ending up with a loss. Hence, what determines the long-term profit of an investor is his ability to evaluate the likelihood of the success or failure of such investments. It helps him decide the size of his capital to wager on them.

For instance, if an investment opportunity shows a high probability of yielding profit, the investor invests a higher percentage of his capital to maximize the profit. On the flip side, he reduces the fraction he invests to minimize losses if the chance of success of the investment is low.

Essentially, the Kelly betting system helps the bettor accurately determine the value of each bet. It then uses this information to decide the exact amount to wager. It helps them minimize risks and make profits in the long run.

Kelly Criterion Formula with Explanation

While it may look complicated at first glance, using the Kelly criterion equation for a sports bet is straightforward.

By using the above formula, you can calculate the optimal amount to wager on any betting opportunity, helping you minimize risks and ensure profit in the long term.

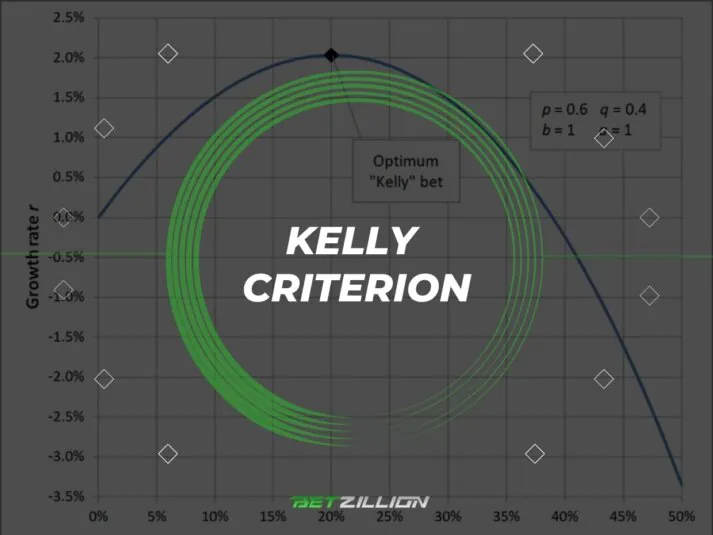

For instance, a die has a 50% or 0.5 probability of landing on 1, 2, or 3 when rolled. It means the chance of landing on 4, 5, or 6 is also 0.5 (1 – 0.5). It implies there is no expected value for both outcomes. However, let’s assume the die is biased and the probability of landing on a 1, 2, or 3 is 60% or 0.5; then the chance of getting a 4, 5, or 6 becomes 40% or 0.4. It implies a positive expected value in betting on a lesser number.

In this case, the Kelly criterion will be calculated thus if the odds for the event are 2:

It means 20% of your bankroll is the optimal amount to wager on this event. If the bias were lesser at a 55% chance, the Kelly percentage would be 10%.

In this case, the Kelly criterion betting strategy suggests that if you wager over 20% of your bank continuously on 1, 2, or 3, there is a high probability of going broke quickly. Conversely, repeatedly wagering a lesser percentage means you are not taking full advantage of the value, shortchanging yourself on your overall profit.

Using Kelly’s criterion for multiple bets is also possible, allowing bettors to allocate their capital across different betting opportunities. However, the formula is modified in this case. Instead of a single fraction of the bankroll, the Kelly Criterion calculates the optimal fraction for each bet. Combined, these fractions determine the overall capital allocation among the simultaneous bets.

An online calculator for Kelly’s criterion of multiple simultaneous bets is often advisable, as the calculations can be complicated and confusing.

Kelly Criterion & Expected Value

Expected value (EV) is an essential element of sports betting, and it is especially vital when using the Kelly betting strategy. EV in sports betting is a way to measure the probability difference between a punter’s expectation and the bookmakers’.

A positive expected value on a wager is when the odds of it winning is higher than what the sportsbooks portray. For instance, if a sportsbook offers 2.5 odds or heads in a coin toss, it deviates from the probability of 50%. It means the odds of the wager winning are now higher than the implied probability, which is 40%, resulting in a positive EV. Positive EV bets usually result in a profit over the long term as their potential payoff outweighs the probability of losing. Conversely, a negative expected value (-EV) indicates that the bet, on average, will result in a loss.

It is essential to note that the effectiveness of the Kelly betting formula relies on the assumption that the wager being considered has a positive expected value (+EV). If a bet has a positive EV, the Kelly Criterion suggests wagering a fraction of the bankroll that corresponds to the ratio of the expected value and the net odds. Conversely, the formula would recommend wagering a negative fraction of the bankroll in the case of a negative EV, which means you shouldn’t place any fraction of your bankroll on the wager.

Knowing which wager has a positive value is subjective in sports betting, as no one can correctly guess the probability of a bet winning. However, the point is to outrightly avoid a wager unless the odds sufficiently offset the risk of the potential loss.

How to Use Kelly Criterion in Betting

Below are some essential points to be considered to succeed when using the Kelly criterion in sports betting.

Determine the probability of winning: Assess the likelihood of your wager’s success. This estimation can be based on statistical analysis, historical data, expert opinions, or other relevant information.

This step is crucial to determining whether a wager is a value bet. Remember, Kelly Criterion is only effective when you spot a wager with a positive expected value.

Calculate the expected value: The formula for EV goes thus:

Apply the Kelly Criterion formula: After deciding your current probability and finding value in your wager, all that is needed is to plug the variables into the Kelly betting formula to get what percentage of your bankroll you should bet.

Assess risk tolerance and adjust position size: It is essential to consider your risk tolerance and adjust the recommended fraction of the bankroll based on your personal preferences and risk management strategy. It is common for bettors to use a fraction smaller than the one suggested by the Kelly betting Criterion to account for risk aversion and potential volatility. It may be 1/2, 1/4, or 1/8 of the Kelly percentage.

Repeat the process for each bet: Repeat the calculations for each bet you are considering. As probabilities and payoffs may change, regularly reassess the parameters to update your position sizes accordingly.

Monitor your results: It is essential to monitor the outcomes closely and track your performance over time. It will help you decide whether to stick to your strategy, adjust your Kelly percentage, or re-evaluate the estimates of your actual probabilities.

Kelly Criterion Calculation & Example in Sports Betting

Now that you have understood how sports betting Kelly Criterion works and how to use the mathematical formula let’s work with some real examples.

Example of Kelly Criterion in Football

Suppose you’re analyzing a Champions League final match between Manchester City and Inter Milan. The odds the bookmaker offers for Man City to win as favorites are 1.9, putting the implied probability at 0.4 or 40%. However, based on your research and analysis, you estimated the likelihood of Man City winning at 0.6 or 60%.

Since you have spotted value, you can calculate the optimal fraction of our bankroll to bet on Man City’s victory using the Kelly Criterion formula.

The result, 0.15, represents the fraction or percentage of our bankroll that the Kelly Criterion suggests we should wager on Man City’s victory. In other words, the formula recommends betting 15% of our bankroll on this outcome.

For example, if we have a bankroll of $1,000, the recommended bet amount would be $150 (0.15 * $1,000).

Example of Kelly Criterion in Horse Racing

Suppose you are betting on a horse race event at the Cheltenham Hurdle, and the odds offered for your horse in a race is 5.0. It means your implied probability is 0.2 or 20%. However, you determine after your analysis that Horse A has a 25% chance of winning. That is, you estimated the actual probability at 0.25, spotting a value.

Using the Kelly betting formula, we can calculate the optimal fraction of our bankroll to bet on each horse:

So, according to the Kelly Criterion, we should wager 6.25% of our bankroll on Horse A.

Analysis of the Results

As mentioned above, the Kelly percentage, denoted in the formula as “f,” is the fraction of your bank to put into an investment. Whether you are betting on sports or investing, analyzing your result after calculating this variable is essential to determine the next step.

Firstly, you must avoid a wager or investment if the Kelly Criterion returns a negative value. Even if you think a bet is highly likely to win, a Kelly percentage less than zero suggests that there is no positive EV. It means the wager will result in losses in the long term. However, a negative percentage is significant in Kelly’s criterion of lay betting. Since a lay bet is the opposite of the regular back bet, a negative “f” variable from the Kelly criterion formula means long-term profitability for lay bets.

Also, remember that the Kelly bet formula is as effective and accurate as the actual probabilities of winning and losing used in it. If these variables are incorrect, it can result in detrimental results.

Kelly Criterion Sports Betting: Pros and Cons

The Kelly system betting helps bettors maximize their long-term capital growth by determining the optimal fraction of their bank to wager on a bet. However, like every betting strategy, system, or formula, it has pros and cons. We will explore this in detail below.

| PROS | CONS |

|---|---|

|

PROS

|

CONS

|

History of the Kelly Criterion

The history of the Kelly Criterion betting system dates back to the 1950s when it was developed by John L. Kelly Jr., a scientist, and mathematician working at AT&T’s Bell Bell Labs in New Jersey. In the same year, it was said that Kelly published a paper titled “A New Interpretation of Information Rate,” which introduced the formula concept.

The Kelly Criterion gained massive recognition in the gambling community, particularly in horse racing games. Professional gamblers saw the formula’s potential to guide their betting strategies and enhance their profitability. Over time, it became synonymous with effective bankroll management and risk optimization in gambling.

Later, investors and portfolio managers began recognizing the relevance of the Kelly criterion betting system in investment management. The formula provided a framework for determining position sizing and risk management, especially when probabilities and payoffs could be estimated. Some of the world’s greatest investors, like Warren Buffet, Bill Gross, and Charlie Munger, are said to have used the Kelly Criterion in their investment strategies.

Why Should You Use Kelly Criterion for Sports Betting?

As explained in this guide, the Kelly Criterion helps you optimize your capital allocation and make informed decisions based on the expected value of bets. Therefore, incorporating the formula into your sports betting strategy enhances your chances of long-term success.

The Kelly betting criterion provides a disciplined approach to bankroll management, helping you avoid impulsive decisions. It considers both the probability of winning and the potential payoff, allowing you to tailor your bet sizes according to your risk tolerance and maximize long-term growth. Furthermore, the flexibility of the strategy enables you to adapt to changing probabilities and odds.

Ultimately, the Kelly Criterion is a valuable weapon in a bettor’s arsenal. By carefully considering its pros and cons, adapting it to individual risk preferences, and employing sound judgment, you can leverage the BetZillion’s winning formula benefits to optimize your capital’s growth rate in the long term.

Frequently Asked Questions

-

Who was Kelly?Kelly’s full name is John L. Kelly Jr., a scientist, and mathematician who developed the Kelly Criterion in the 1956s. He worked at AT&T’s Bell Labs and published a paper titled “A New Interpretation of Information Rate,” introducing the concept of the Kelly Criterion for optimizing capital allocation in gambling and investment.

-

Is the Kelly Criterion betting strategy illegal?No, the Kelly Criterion betting strategy is not illegal. It is a mathematically-based method for bankroll management and risk optimization. However, note that each bookmaker may have minimum and maximum staking limits, which may limit the application of the formula in real-world sports betting scenarios.

-

Is the Kelly Criterion System allowed in bookmakers?Yes. While bookmakers may have certain restrictions or limitations on bet sizes, the Kelly Criterion is a well-known and widely accepted strategy for maximizing profits and limiting losses. However, it’s essential to understand and comply with each bookmaker’s specific rules and guidelines to ensure proper implementation of any strategy within their platform.

-

Is Kelly’s Criterion a safe method for betting?The Kelly Criterion is a safe general bankroll management system for investment and betting. Hence, it’s popular among the world’s best investors like Warren Buffet. However, its effectiveness in real-life scenarios depends on accurate probability estimates.

-

Can I bet on football with the Kelly Criterion formula?Yes, you can apply the Kelly Criterion formula to almost all forms of sports betting, including football. By considering your bankroll, the expected value, and the potential payoff of a wager, the formula helps football bettors by suggesting the ideal bet size for mitigating losses and maximizing long-term growth.

-

Still have questions?

Ask our experts

Related articles

All-in on Odds at 1.20 Football Betting

Paroli Betting System